Tonight, I could have been binge-watching the latest Blockbuster original on my Nokia smartphone, flipping through a digital Sears catalog for a new pair of jeans, or posting Kodak-filtered photos on my feed. These once-industry giants and household names are now chapters in corporate history, while Netflix, Apple, Amazon, and Instagram reign supreme.

Why did they fall?

Well, it certainly wasn’t the usual suspects, like lousy luck, restrictive laws, or massive lawsuits.

Nope, instead, they all shared a common and unimaginably simple and preventable flaw: failing to interpret and act on the data staring them in the face.

Blockbuster: A Downfall in the Making

And yet, in under a decade, it was gone.

Some say Blockbuster’s downfall came from refusing to embrace digital. “Blockbuster clung to its stores while Netflix showed the potential of streaming,” notes retail analyst Scott Rothbort. Others blame the late fees that raked in revenue but frustrated customers who ultimately switched to Netflix. “Late fees alienated customers eager for a friendlier option,” says media strategist Joshua Horwitz.

Another big factor?

Blockbuster’s debt-heavy model made it incredibly rigid. Financial analyst Aswath Damodaran says, “High debt kept Blockbuster from pivoting, while Netflix and Amazon had the agility to innovate fast.”

Blockbuster missed, or worse, ignored these red flags, failing to make proactive shifts and adapt to the changing landscape.

It Could Have Been Different

Blockbuster wasn’t short on data or a corporate giant in denial. Its fall came down to three main issues: first, it struggled to turn raw data into actionable KPIs. Second, it failed to visualize these KPIs in a way that pushed leadership toward change. And third, although it had reports, it never built a KPI-driven culture.

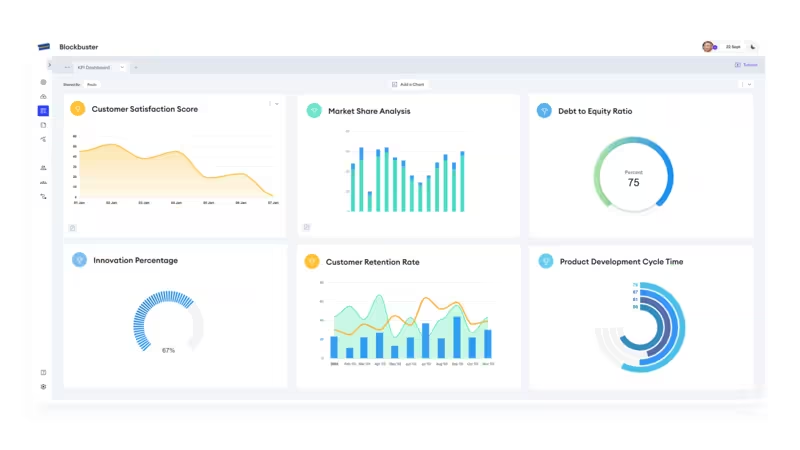

With a well-designed KPI dashboard, Blockbuster could have tracked the metrics that mattered, set a course for digital, and been nimble enough to pivot. This dashboard would have allowed them to spot trends, respond to customer needs, and adjust strategies with speed.

Yes, hindsight makes it easy to judge, but imagine if Blockbuster had used this clarity to look forward. They could have seen the digital revolution coming, outpaced competitors, and stayed a Saturday-night staple. And they wouldn’t have needed a massive amount of KPIs—just a select few to keep them competitive:

The KPIs That Could Have Saved Blockbuster

The Digital Adoption Rate

This KPI measures the percentage of customers engaging with digital services like online rentals or streaming—an indicator of where customer interest is headed. Tracking this rate would have shown Blockbuster just how fast digital demand was rising, flagging an urgent need to prioritize digital services.

Competitive Market Share Analysis

A dedicated look at this KPI would have spotlighted Netflix’s rising popularity, alerting Blockbuster to the need for a strategic shift. Instead of dismissing Netflix as a niche service, Blockbuster could have recognized it as a credible threat.

Customer Satisfaction Score (CSAT)

Tracking CSAT would have made it clear just how unhappy customers were with Blockbuster’s late fees. Early insight into customer dissatisfaction could have prompted management to adopt more customer-friendly policies, reducing churn and possibly even extending Blockbuster’s relevance in a shifting market.

Early insight into customer dissatisfaction could have prompted management to adopt more customer-friendly policies, reducing churn and keeping Blockbuster as a go-to entertainment choice. This small pivot alone might have earned Blockbuster years of brand loyalty, slowing Netflix’s rise as the customer-first alternative.

Debt-to-Equity Ratio

With a watchful eye on its Debt-to-Equity Ratio, Blockbuster might have sidestepped financial overextension. This KPI shows a company’s financial leverage by comparing debt to equity, highlighting when debt is becoming unsustainable. Blockbuster’s debt-heavy model left it with little room to innovate, while leaner competitors like Netflix were better equipped to reinvest in technology.

By tracking and maintaining a sustainable debt level, Blockbuster could have preserved funds for digital innovation and restructured its business model, making it less dependent on physical stores and high-volume, high-cost operations. A healthier balance sheet would have given Blockbuster the financial freedom to pivot with the market instead of being constrained by debt.

Innovation Investment as a Percentage of Revenue

Tracking Innovation Investment as a Percentage of Revenue could have propelled Blockbuster into the streaming space much earlier. This KPI measures how much revenue a company dedicates to innovative projects like digital services, reflecting commitment to forward-thinking initiatives. A steady target for tech investment would have ensured digital transformation stayed on Blockbuster’s radar, giving them a competitive streaming platform before Netflix dominated the space.

Had Blockbuster funneled even a small percentage of its revenue into building a digital service, they could have created a compelling alternative to Netflix, appealing to existing customers and keeping them loyal as digital preferences took over.

Product Development Cycle Time

Product Development Cycle Time measures the speed from product concept to launch, encouraging agility in adapting to market needs. This KPI would have helped Blockbuster move quickly from concept to execution, allowing it to roll out digital offerings before Netflix could capture a monopoly on streaming.

Faster development times would have allowed Blockbuster to test and iterate on digital products to match customer demands and outpace competitors. By tracking this KPI, Blockbuster could have embraced an agile culture, making it responsive to industry shifts and customer needs.

Customer Retention Rate

Customer Retention Rate is the ultimate indicator of loyalty, showing the percentage of customers who continue to use a company’s services over time. A declining retention rate would have shown Blockbuster that customers were migrating to Netflix and other competitors. By identifying these loyalty shifts early, Blockbuster could have diversified its services and improved the customer experience to keep its core audience engaged.

Tracking customer retention would have been a clear signal to act fast, invest in digital, and implement loyalty programs to reinforce its brand in the eyes of customers.

A Culture Beyond KPIs

While the right KPIs and a powerful dashboard could have provided Blockbuster with a roadmap, data alone wouldn’t have saved the company. To truly thrive, Blockbuster needed a culture that didn’t just collect KPIs but actively interpreted and acted on them. Without this mindset, even the most valuable insights risk being overlooked.

Blockbuster’s downfall wasn’t inevitable; with a KPI-driven culture ready to embrace change, they could have countered the disruptions that ultimately unseated them. In the end, these companies weren’t just victims of natural market shifts. They failed to interpret their data and adapt, falling behind as their industries evolved.

So, next time you queue up Netflix, remember: industry giants don’t fall solely from a lack of innovation—they fall by ignoring the KPIs that could have kept them in the game.

by Stuart Kinsey

Stuart Kinsey writes on Key Performance Indicators, Dashboards, Marketing, and Business Strategy. He is a co-founder of SimpleKPI and has worked in creative and analytical services for over 25 years. He believes embracing KPIs and visualizing performance is essential for any organization to thrive and grow.