Streamlining Insurance Claims with KPI Dashboards

Insurance companies face the challenge of processing claims efficiently while maintaining high customer satisfaction. KPI dashboards provide actionable insights into claims resolution times, cost efficiency, and customer feedback, enabling companies to optimize their operations.

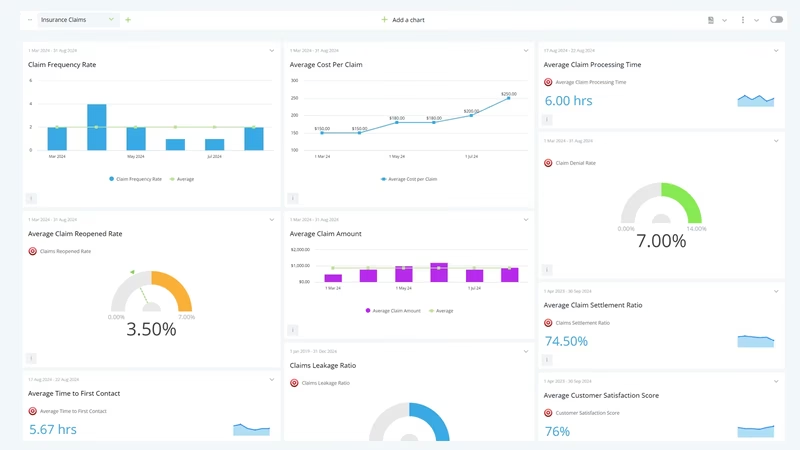

Key Metrics in the Dashboard

- Claim Resolution Time: Average time taken to resolve claims.

- Customer Satisfaction Score: Feedback from customers post-claim resolution.

- Cost Per Claim: Average cost incurred per claim processed.

- Claims Processed Per Day: Number of claims handled daily.

- Fraud Detection Rate: Percentage of fraudulent claims identified.

Who Benefits from This Dashboard?

This dashboard is designed for claims managers, customer service teams, and executives in the insurance industry. It helps them monitor performance, identify bottlenecks, and improve overall efficiency.